Getting a bank loan for your business is key to growth and success. But, the process needs a lot of paperwork, which can be overwhelming. This guide will help you understand what documents you need for a business bank loan. It will make you more confident in applying for a loan and boost your chances of getting the funding your business needs.

Knowing the importance of good documentation is crucial. You’ll learn about the documents needed, like personal and business financial statements, tax returns, and collateral. This knowledge will help you prepare a strong loan application. By understanding what documents are required, you can make the application process smoother and improve your chances of getting the loan your business needs.

Understanding the Importance of Proper Documentation

When you apply for a business loan, having the right documents is key. Banks check your loan application to see if your business is a good risk. The documents you need give them a peek into your finances, management team, and how your business runs.

Getting your business loan documents ready early can make things easier. It shows you’re ready for the lender.

Why Banks Require Extensive Paperwork

Banks want to know everything about your business before they say yes to a bank loan. They look at your credit history, cash flow, what you own, and your business plan. This helps them decide if they can trust your business.

The Benefits of Being Prepared

Having your documents required for bank loan ready early makes your application look good. It shows you’re serious and detail-oriented. Plus, it can save you time by avoiding extra requests for info.

| Document | Purpose |

|---|---|

| Business Plan | Outlines your business strategy, financial projections, and growth plans. |

| Financial Statements | Provide a comprehensive view of your company’s financial health and performance. |

| Tax Returns | Demonstrate your company’s historical financial performance and compliance. |

| Collateral Documentation | Identifies any assets you can use as security for the bank loan. |

Knowing how important documents are can make you feel more confident when applying for a bank loan. It can also help you get the funding your business needs.

Personal and Business Financial Statements

When you apply for a business loan, banks ask for both personal and business financial statements. These documents show your assets, liabilities, income, and expenses. They help lenders see if you’re creditworthy and if your company is financially healthy.

Personal financial statements show your personal money situation. They include your savings, investments, and real estate, as well as your debts. This helps the bank know if you can pay back the loan with your own money.

Business financial statements, however, focus on your company’s finances. They might include your company’s balance sheet, income statement, and cash flow statement. These statements show your business’s income, expenses, profits, and financial stability. This is key for the bank’s decision.

By providing accurate and current personal and business financial statements, you show you’re transparent and serious about the loan. Getting these business loan documents ready early can help you get the small business loan documentation you need to grow your business.

| Personal Financial Statements | Business Financial Statements |

|---|---|

| Balance Sheet Income Statement Cash Flow Statement | Balance Sheet Income Statement Cash Flow Statement |

“Providing accurate and up-to-date financial statements is crucial in the business loan application process. These documents demonstrate your commitment to financial transparency and help lenders assess your creditworthiness.”

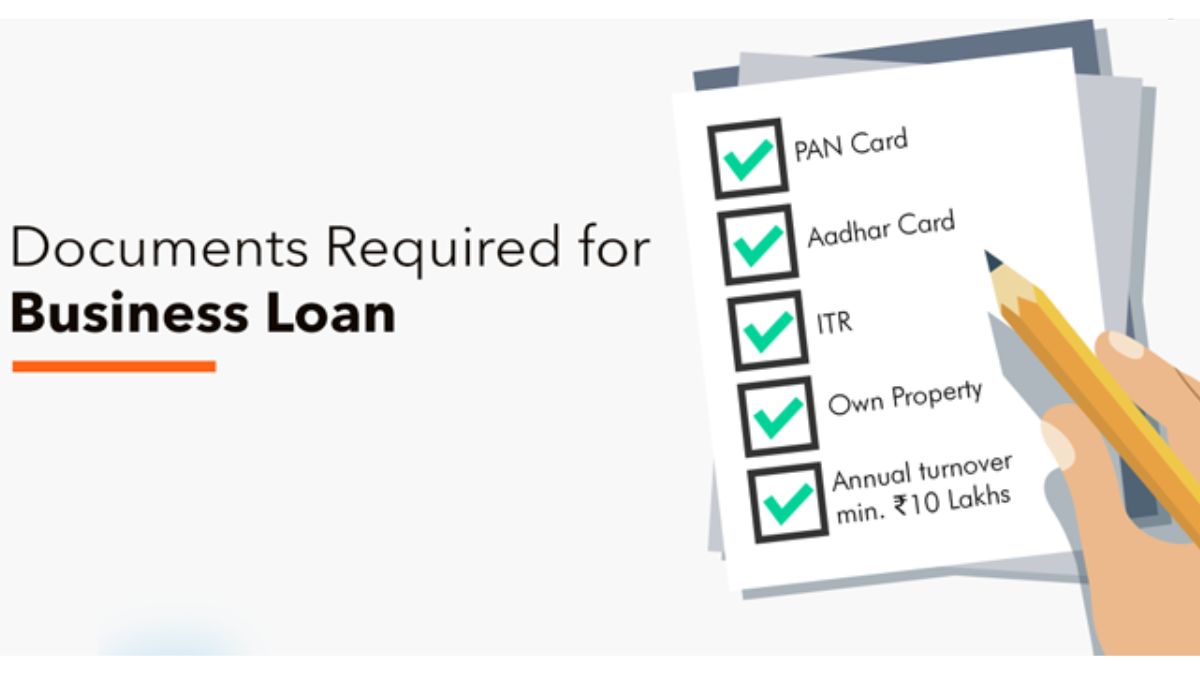

Documents Required for Bank Loan for Business

When you apply for a business loan, banks need a lot of documents. They check your company’s credit and how it runs. Knowing what documents you need can make applying easier and boost your chances of getting the loan.

Business Plan and Projections

A good business plan is key for your loan application. It shows the bank how you understand the market and your strengths. It also proves you can make money and profits. Your plan should cover:

- Executive summary

- Company description

- Market analysis

- Products and services

- Operations plan

- Management team

- Financial projections

Legal Documents and Licenses

Banks also want to see your business’s legal side. They check if you’re following the law and if your business is real. You’ll need to provide:

- Articles of incorporation or partnership agreement

- Business licenses and permits

- Commercial leases or property deeds

- Franchise agreements (if applicable)

- Intellectual property registrations

These documents show your business is legal and follows the rules. This is important for the bank’s safety checks.

“Having all the necessary documents organized and ready to submit can significantly expedite the loan application process and increase your chances of approval.”

Income Tax Returns and Financial Statements

When you apply for a business loan, your income tax returns and financial statements are key. Lenders check these to see if you can pay back the loan. They look at your income and credit to make this decision.

Personal Tax Returns

It’s important to share your personal tax returns, like Form 1040, and any schedules. These show your income, deductions, and taxes owed. Good personal tax returns show you’re financially stable.

Business Tax Returns

Lenders also want to see your business tax returns, like Form 1120 for corporations or Form 1065 for partnerships. These show how your business is doing financially. Keeping your business tax returns current and accurate is vital for paperwork for business loan approval.

Having all the right mandatory documents for business loan applications, like personal and business tax returns, helps a lot. It shows you’re financially stable and can repay the loan. This makes the loan approval process easier and boosts your chances of getting the funding your business needs.

“Providing accurate and up-to-date tax returns is essential for securing a business loan. Lenders use these documents to assess your financial profile and determine your ability to repay the loan.”

Collateral Documentation

When you apply for a business loan, you might need to show collateral. Collateral is something you offer as security, like real estate, equipment, or inventory. The bank will check the value of these assets to see how much they can lend you.

To prove you own the collateral and its value, you’ll need to provide certain documents required for bank loan and business loan documents:

- Appraisal reports for any real estate or equipment you plan to use as collateral

- Proof of ownership, such as deeds, titles, or lease agreements

- Detailed inventories and photographs of the collateral assets

- Estimates of the current market value of the collateral

- Insurance policies covering the collateral assets

By showing detailed collateral documents, you prove you have the assets to secure the loan. This can help the bank decide to approve your loan.

| Collateral Type | Documentation Required |

|---|---|

| Real Estate | Deeds, appraisal reports, property tax records, insurance policies |

| Equipment | Bills of sale, equipment lists, maintenance records, insurance policies |

| Inventory | Detailed inventory lists, supplier invoices, insurance policies |

By giving the bank complete documents required for bank loan and business loan documents on your collateral, you make your application stronger. This can help you get the financing you need to grow your business.

Credit Reports and Credit Scores

Getting a bank loan for your business means lenders will check your personal and business credit. Your credit reports and scores are key to showing you’re creditworthy. Keeping your credit strong can help you get the documents needed for business financing you need.

Personal Credit History: The Foundation of Trust

Lenders look at your personal credit history to see if you handle debt well. They check for things like on-time payments and how much credit you use. Having a correct and current personal credit report can help you get a small business loan documentation.

Business Credit History: Showcasing Your Company’s Creditworthiness

Lenders also check your business’s credit history. They look at your payment patterns and how much credit you use. A strong business credit history shows your company is reliable, making it easier to get financing.

| Credit Metric | Personal Credit | Business Credit |

|---|---|---|

| Credit Score | FICO or VantageScore | PAYDEX, Equifax, or Experian Business Credit Score |

| Payment History | On-time payments on personal credit accounts | On-time payments on business credit accounts |

| Credit Utilization | Ratio of used to available credit on personal accounts | Ratio of used to available credit on business accounts |

| Credit History Length | Age of personal credit accounts | Age of business credit accounts |

Knowing how personal and business credit histories matter can help. You can work on keeping your credit in good shape. This makes it easier to get the documents needed for business financing and boosts your loan approval chances.

Additional Supporting Documents

When you apply for a business bank loan, lenders might ask for more documents. They want to understand your business and management team well. These extra materials help show you’re ready for the loan.

Resumes and Bios

Lenders want to see resumes and bios of your key team members. This includes the owner, executives, and important team members. These documents help lenders see if your team has the right skills and experience.

By showing your team’s background, you prove your company is ready to use the loan. This shows you’re serious about your business.

References and Recommendations

Lenders also ask for references or recommendations. They want to hear from people who know your business. This could be industry professionals, business partners, or others who can speak to your company’s reputation.

These extra documents give lenders a full picture of your business bank loan prerequisites and the commercial loan document checklist. They help show you’re serious about getting the loan.

By gathering and presenting these documents well, you show you’re ready and professional. This can help you get a good loan decision.

Streamlining the Loan Application Process

Getting a business loan is easier when you’re well-prepared. Having all your paperwork for business loan approval ready can make things smoother. This shows you’re serious and can help get your loan approved.

Start by making a list of the mandatory documents for business loan your lender will ask for. This includes financial statements, tax returns, and legal documents. Having these documents ready can save time and show your financial health.

Also, organize your documents well. Use a file system or digital folder to keep everything in order. This shows you’re detail-oriented and serious about the loan process.

Being well-prepared makes the loan application easier. By organizing your paperwork, you can speed up the process. This increases your chances of getting the funding your business needs to grow.

| Document | Description |

|---|---|

| Business Plan and Projections | A detailed plan with your business goals, strategies, and financial plans. |

| Legal Documents and Licenses | Documents like incorporation papers and business licenses that prove your business is legitimate. |

| Income Tax Returns and Financial Statements | Personal and business tax returns, and financial statements that show your financial history and current status. |

| Collateral Documentation | Proof of ownership and value of assets you plan to use as collateral for the loan. |

| Credit Reports and Credit Scores | Personal and business credit reports and scores that show your creditworthiness. |

| Resumes and Bios | Information about your management team, highlighting their experience and expertise. |

Having all the paperwork for business loan approval ready can make the loan application process easier. This increases your chances of getting the funding your business needs to succeed.

Read More…..

- Federal Student Loan Rights & Responsibilities Guide

- Federal Student Loan Forgiveness for Disability

- How To Get Biden Student Loan Forgiveness

- How To Apply For Bank Loan In The Philippines

- Capital One Personal Loan Pre Approval Reviews

- Best Student Loan Repayment Plan for High Income

Conclusion

Getting a business bank loan needs careful planning and the right documents. Knowing what you need can help your business grow. Important papers like financial statements and legal documents are key.

When you gather the documents required for bank loan for business, you show lenders you’re stable and ready. This set of business loan documents makes the bank loan paperwork easier. It also shows you’re serious about managing money well.

Spending time to get these documents right can really help. With a solid loan application, you can feel confident. This confidence can help you achieve your business dreams.

What are the essential documents required for a business bank loan?

You’ll need personal and business financial statements, tax returns, and a business plan. Also, legal documents and licenses, and collateral details if you have them.

Why do banks require so much paperwork for a business loan?

Banks check your loan to see if it’s safe. They look at your financial history, team, and business. Having your documents ready shows you’re serious and prepared.

How can I prepare my personal and business financial statements for a loan application?

Make sure your financial statements show your assets, debts, income, and expenses clearly. Keeping these up-to-date and accurate will help your loan application.

What legal documents and licenses do I need to provide for a business loan?

Banks want to see your business’s legal papers like articles of incorporation and licenses. These prove your business is real and follows the law.

How can I streamline the business loan application process?

Get all your documents ready before applying. This shows you’re organized and serious, which can help your loan get approved.