Getting a bank loan in the Philippines is easy if you know what you need. This guide will cover everything from who can apply to what documents you’ll need. We’ll also share tips to boost your chances of approval.

The Philippines has many bank loan options. Each has its own rules and perks. Knowing about personal and business loans can help you choose the right one for your needs. Things like interest rates and repayment plans are also important.

With the right steps and documents, applying for a bank loan becomes straightforward. You’ll learn about income and credit score needs, as well as what documents to prepare. This guide will help you apply with confidence.

This article is for both new and experienced borrowers. It’s packed with info to help you get the loan you need. Whether it’s for personal, business, or investment, we’ve got you covered. Let’s explore the world of bank loans in the Philippines together.

Understanding Bank Loans in the Philippines

Exploring bank financing options in the Philippines is key. Knowing the types of loans and their benefits is crucial. Whether for personal or business needs, the right loan can help you reach your goals.

Types of Bank Loans Available

The Philippine banking industry offers a wide range of loans. These cater to different financial needs. Here are some common types:

- Personal Loans: These are for individual needs, like debt consolidation or medical bills.

- Business Loans: Designed for entrepreneurs, these loans fund business growth or equipment purchases.

- Home Loans: Known as mortgages, these help buy or refinance homes.

- Auto Loans: These loans make buying a new or used car easier.

Benefits of Securing a Bank Loan

Getting a bank loan in the Philippines has many benefits. Here are a few:

- Competitive Interest Rates: Banks offer good interest rates, making loans attractive.

- Flexible Repayment Terms: Loans often have flexible repayment plans, fitting your budget.

- Access to Larger Loan Amounts: Banks can offer more money than other options, for bigger projects.

- Opportunity to Build Credit History: Paying off a loan responsibly can boost your credit score.

Understanding bank loans and their benefits helps you make smart choices. This way, you can get the financing you need in the Philippines.

Eligibility Criteria for Bank Loans

Getting a bank loan in the Philippines means you must meet certain criteria. Knowing these criteria well can boost your loan approval chances. Key factors include your income requirements and your credit score and history.

Income Requirements

Banks in the Philippines set a minimum income for loan applicants. This income amount changes based on the loan type and bank policies. You might need to show payslips, bank statements, or tax returns to prove your income. Having a stable and verifiable income is crucial.

Credit Score and History

Your credit score and history are vital for banks. They look at how you’ve handled past loans. A high credit score and clean history can help you get a bank loan. It’s wise to check your credit report often to spot and fix any problems.

| Eligibility Criteria | Requirement |

|---|---|

| Income | Minimum monthly income of ₱20,000 for personal loans, and higher for other loan types |

| Credit Score | Minimum credit score of 700 (out of 1,000) for most bank loans |

| Credit History | No history of loan defaults or delinquencies in the past 3-5 years |

Understanding and meeting the bank loan eligibility criteria can help you get the financing you need. Remember, each bank has its own rules. So, it’s smart to research and compare to find the right loan for you.

Preparing for the Loan Application Process

Getting ready for a bank loan application in the Philippines is key. You need all the right documents and info. This makes the bank loan application process easier and boosts your approval chances.

Before starting, collect these important items:

- Proof of Income: This includes your latest payslips, income tax returns, or bank statements showing steady income.

- Identification Documents: You’ll need valid government-issued IDs, like your passport or driver’s license.

- Personal Details: Be ready to share your address, contact info, and job status.

- Financial Statements: Gather your recent bank statements, credit card bills, and other financial records to show your creditworthiness.

- Collateral Documents: For a secured loan, you’ll need to provide documents for the asset you’ll use as collateral, like property titles or vehicle registration.

Having these documents ready makes the application process more efficient. It also shows the bank you’re a responsible borrower. This increases your chances of getting approved for a bank loan.

Being well-prepared makes the bank loan application smoother. By gathering all the necessary info and documents, you’re on the right path to getting the financing you need.

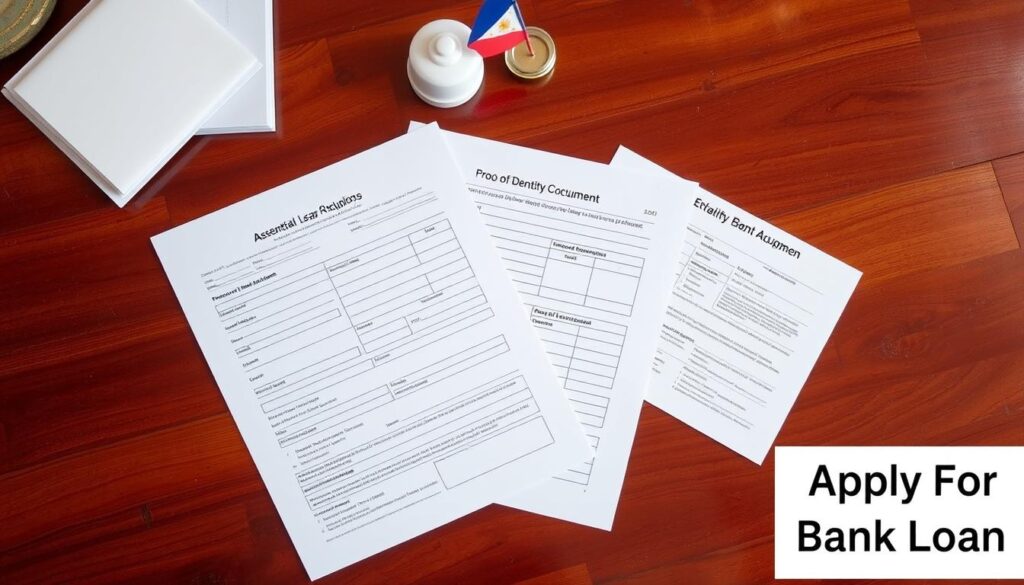

Required Documents for Bank Loan Application

When you apply for a bank loan in the Philippines, you need to gather important documents. These documents help banks understand your financial situation. They use this information to decide if you qualify for a loan.

Proof of Income

Showing your proof of income is crucial for getting a bank loan. Here are some documents you might need:

- Latest 3-6 months of payslips or income statements

- Bank statements showing regular deposits and income

- Certificate of Employment (COE) or Income Tax Return (ITR) from your employer

- Business financial statements (if you’re self-employed)

Identification and Personal Details

You also need to provide identification and personal details for your loan application. This includes:

- A valid government-issued ID (e.g., passport, driver’s license, or national ID)

- Proof of address (e.g., utility bills, lease agreement, or tax declaration)

- Contact information (e.g., phone number, email address, and mailing address)

- Borrower’s information (e.g., date of birth, marital status, and number of dependents)

By collecting these documents needed for bank loan philippines, proof of income for bank loan, and personal details for bank loan, you’re ready to apply for a bank loan in the Philippines.

How To Apply For Bank Loan In The Philippines

Getting a bank loan in the Philippines is easy if you know the steps. The bank loan application process has several stages. You need to check if you qualify and gather the right documents.

Applying for a bank loan in person is a good option. You can talk to a loan officer and get help. Or, you can apply online or through the bank’s app for a quicker process.

The bank loan application process usually takes a few days to weeks. The bank will check your finances and credit to see if you qualify. They will also decide on the loan terms.

| Step | Description |

|---|---|

| 1. Determine Your Eligibility | Review the bank’s eligibility criteria, including income requirements and credit history. |

| 2. Gather Required Documents | Collect the necessary documents, such as proof of income, identification, and personal details. |

| 3. Submit the Application | Visit the bank in person, apply online, or use the mobile banking app to submit your loan application. |

| 4. Application Review and Approval | The bank will review your application and notify you of the decision, which can take several business days to a few weeks. |

By knowing how to apply for a bank loan in the Philippines, you can get the funding you need. Just follow the steps and increase your chances of success.

Comparing Loan Offers and Interest Rates

After applying for a bank loan, you might get offers from several banks. It’s important to compare these offers carefully. Look at the interest rates and repayment terms. This will help you pick the loan that fits your financial situation best.

Understanding Loan Repayment Terms

When looking at loan offers, focus on the repayment terms. This includes how long you’ll pay back the loan and how often. Shorter terms mean higher monthly payments but less interest over time. Longer terms mean lower payments but more interest.

| Bank | Loan Amount | Interest Rate | Repayment Term | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Bank A | ₱500,000 | 7.5% | 5 years | ₱10,345 | ₱120,700 |

| Bank B | ₱500,000 | 8.0% | 7 years | ₱8,800 | ₱160,400 |

| Bank C | ₱500,000 | 6.5% | 3 years | ₱14,950 | ₱78,200 |

The table shows a comparison of three bank loan offers. It highlights key factors like loan amount, interest rate, and repayment term. By looking at these, you can choose the best loan for your needs.

Remember, you want a loan that’s easy to pay back but also affordable. By comparing offers and understanding repayment terms, you can make a smart choice. This choice will help you meet your financial goals.

Secured vs. Unsecured Bank Loans

In the Philippines, you can get a bank loan in two ways: secured or unsecured. Knowing the difference helps you choose the right loan for you.

Collateral Requirements

Secured loans need collateral, like real estate or cars. This collateral protects the lender if you can’t pay back the loan.

Unsecured loans don’t need collateral. Instead, the lender looks at your credit and income. This makes them easier to get, especially if you don’t have much to offer as collateral.

| Secured Bank Loans | Unsecured Bank Loans |

|---|---|

| Require collateral, such as real estate or vehicles | Do not require any collateral |

| Typically offer lower interest rates due to the reduced risk for the lender | Often have higher interest rates as the lender takes on more risk |

| Borrowers may be able to secure larger loan amounts | Loan amounts are generally smaller due to the higher risk |

| Collateral can be seized by the lender if the borrower defaults | Lender has limited recourse if the borrower defaults |

Choosing between a secured or unsecured loan depends on your financial situation. Think about your loan’s purpose and if you can repay it. Talking to a financial advisor or the bank can help you make the best choice for you.

Tips for Increasing Your Chances of Loan Approval

Applying for a bank loan can be tough, but with the right strategies, you can boost your chances. Here are some valuable tips to keep in mind:

- Maintain a Solid Credit History: Banks look closely at your credit score and history. Make sure your credit report is correct and you’ve paid your debts on time.

- Provide Comprehensive Financial Documentation: Banks need to understand your financial situation. Prepare all necessary documents, like proof of income and bank statements, to show you can repay the loan.

- Understand the Bank’s Specific Requirements: Each bank has its own criteria for loan approval. Research the bank you’re applying to and tailor your application to meet their needs.

- Seek Professional Guidance: Getting help from a financial advisor or loan officer can be beneficial. They can guide you through the process and help you avoid common mistakes.

- Optimize Your Debt-to-Income Ratio: Banks like applicants with a low debt-to-income ratio. This shows you can handle your financial obligations. Try to reduce your debts and increase your income to improve this ratio.

By following these tips, you can increase your chances of getting approved for a bank loan in the Philippines. This will help you achieve your financial goals.

| Tip | Description |

|---|---|

| Maintain a Solid Credit History | Banks closely examine your credit score and history when evaluating your loan application. Ensure that your credit report is accurate and that you have been diligent in making timely payments on your existing debts. |

| Provide Comprehensive Financial Documentation | Banks require a thorough understanding of your financial situation. Gather and prepare all the necessary documents, such as proof of income, bank statements, and financial statements, to demonstrate your ability to repay the loan. |

| Understand the Bank’s Specific Requirements | Different banks may have unique criteria for approving loans. Research the specific requirements of the bank you are applying to, and tailor your application accordingly. |

| Seek Professional Guidance | Consider consulting with a financial advisor or an experienced loan officer to help you navigate the application process and identify any potential obstacles that may hinder your chances of approval. |

| Optimize Your Debt-to-Income Ratio | Banks typically prefer applicants with a low debt-to-income ratio, as this indicates your ability to manage your financial obligations. Work on reducing your outstanding debts and increasing your income to improve this ratio. |

By following these tips for getting approved for a bank loan and increasing your chances of bank loan approval, you can improve your chances of securing the financing you need to achieve your financial goals in the Philippines.

“The key to getting a bank loan approved is to demonstrate your financial responsibility and your ability to repay the loan. By following these tips, you can put your best foot forward and increase your chances of success.”

Managing Your Bank Loan Responsibly

Getting a bank loan is just the start. The real challenge is managing it well. Follow these best practices for a smooth loan experience. First, make sure to pay on time. Know your repayment schedule and set reminders to avoid late payments.

It’s also key to talk openly with your lender. They can offer valuable advice and support during your loan term.

Managing your bank loan responsibly means more than just paying on time. Understand your loan’s terms, like interest rates and fees. This helps you budget better and make smart financial choices.

Also, keep an eye on your credit score. This ensures there are no errors that could hurt your ability to repay your bank loan later.

Being proactive with your loan can improve your credit and financial health. It also builds trust with your lender. This trust can open doors to more financial opportunities in the future.

Read More….

- How To Get Biden Student Loan Forgiveness

- Federal Student Loan Forgiveness for Disability

- Federal Student Loan Rights & Responsibilities Guide

- SBI Personal Loan Calculator for Salary Accounts

- Types of Loans and Advances in Banking Explained

FAQ

What are the different types of bank loans available in the Philippines?

In the Philippines, you can get personal loans, business loans, home loans, and auto loans. Each loan has its own rules, interest rates, and how you’ll pay it back.

What are the benefits of securing a bank loan in the Philippines?

Getting a bank loan in the Philippines has many benefits. You get good interest rates, flexible payment plans, and a chance to improve your credit score.

What are the income requirements for a bank loan in the Philippines?

To get a bank loan, you need to show you have enough money coming in. This can be through payslips, tax returns, or other income proofs.

How important is my credit score and history for a bank loan application?

Your credit score and history are very important. Banks check them to see if you’re a good risk. A good credit score can help you get a loan.